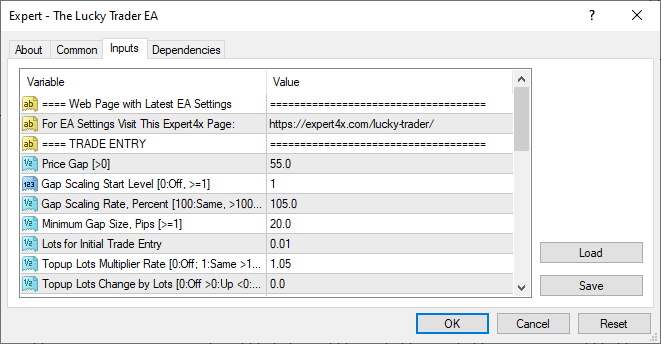

TRADE ENTRY

Price Gap

Determines where the EA enters a new topup trade as the market price moves against the last topup by this number of pips. The topup trades will be gapped from each other by this number of pips, forming a ladder as the market price keeps moving against the initial trade.

Refer to the examples for more details.

Gap Scaling Start Level

When the market price goes against the direction of the initial trade the Price Gap is scaled up or down. The scaling starts when the price moves against the initial trade by this number of levels and applied to all the subsequent levels.

Refer to the examples for more details.

Gap Scaling Rate

The percent rate of scaling by which the price gap gets bigger or smaller. When the market price goes against the direction of the initial trade the Price Gap is scaled up or down by this rate. The scaling starts when the price moves against the initial trade by the configured price levels and applied to all the subsequent levels.

| Price Gap Scaling Rate | Description |

|---|---|

| Above 100 | Scales UP the price gap and it becomes bigger by that rate. For example:

|

| Exactly 100 | No change to the price gap size. 100 means keep it the same, at the 100% of the previous level's gap. |

| Below 100 | Scales DOWN the price gap and it becomes smaller by that rate. For example:

|

Refer to the examples for more details.

Minimum Gap Size

The lower limit or the floor for the price gap scaling, in pips. The price gap scaling may reduce the gap by the rate configured. The EA ensures that the scaled down gap never becomes smaller than this Minimum Gap Size pips.

Refer to the examples for more details.

Lots for Initial Trade Entry

The number of lots which is used to enter the initial trade.

The potential subsequent topup trades may have different lots sizing according to the Topup Lots Multiplier and Topup Lots Change by Lots settings.

The direction of the initial trade is random, i.e. not determined by any indicator or chart pattern but randomly picked as buy or sell.

Refer to the examples for more details.

Topup Lots Multiplier

The rate of change which is used to scale the lots size for the topup trades at each entry.

During the scaling the EA ensures that the scaled lots sizes stay within the broker required minimum and maximum lots range.

| Topup Lots Multiplier | Description |

|---|---|

| Above 1.0 | Scales UP the lots for the topup trade at the entry. For example:

|

| Exactly 1.0 | No change to the lots. 1.0 means keep it the same, at the 100% of the previous level's lots. |

| Below 1.0 | Scales DOWN the lots for the topup trade at the next entry. For example:

|

| Excatly 0.0 | This lots multiplier is not used. Instead the Topup Lots Change by Lots is used to scale the lots. |

Refer to the examples for more details.

Topup Lots Change by Lots

The amount of change which is used to scale the lots size for the topup trades at each entry.

During the scaling the EA ensures that the scaled lots sizes stay within the broker required minimum and maximum lots range.

| Topup Lots Change by Lots | Description |

|---|---|

| Above 0.00 | Scales UP the lots for the topup trade at the entry. For example:

|

| Exactly 0.00 | This change by lots is not used. Instead the Topup Lots Multiplier is used to scale the lots. |

| Below 0.00 | Scales DOWN the lots for the topup trade at the next entry. For example:

|

Refer to the examples for more details.